2026 is coming up fast. Solar tax credit requirements are going to change.

The 30% residential solar tax credit (25D) is ending, but the commercial 48E credit—including bonus credits like domestic content—will remain for third-party ownership structures. To receive the full 48E 30% base credit, developers must now ensure their projects meet new rules limiting Foreign Entity of Concern (FEOC) materials.

Domestic & FEOC-Free Systems

Be Prepared for 2026 & Beyond

At midnight on December 31st, 2025, the solar landscape will change.

Starting January 1st of 2026, our systems will meet the new Foreign Entity of Concern (FEOC) requirements—ensuring full eligibility for federal tax credits under the Inflation Reduction Act (IRA).

The 30% residential solar tax credit, or ITC (25D), will be gone. The commercial solar tax credit, known as 48E, will remain for all third-party ownership structures like leases, PPAs, and pre-paid PPAs. Bonus credits that also remain for commercial taxpayers, like the domestic content bonus credit, will be sought after, but reliant on potentially limited supply, particularly on the module side of the bill of materials.

To capture the 48E 30% base credit, however, commercial developers and TPO providers will now need to ensure that a certain percentage of their project(s) are free from Foreign Entity of Concern, or FEOC, material. This percentage was established in the One Big Beautiful Bill (Sec 7701(a)(52)(A)(i)(ii)).

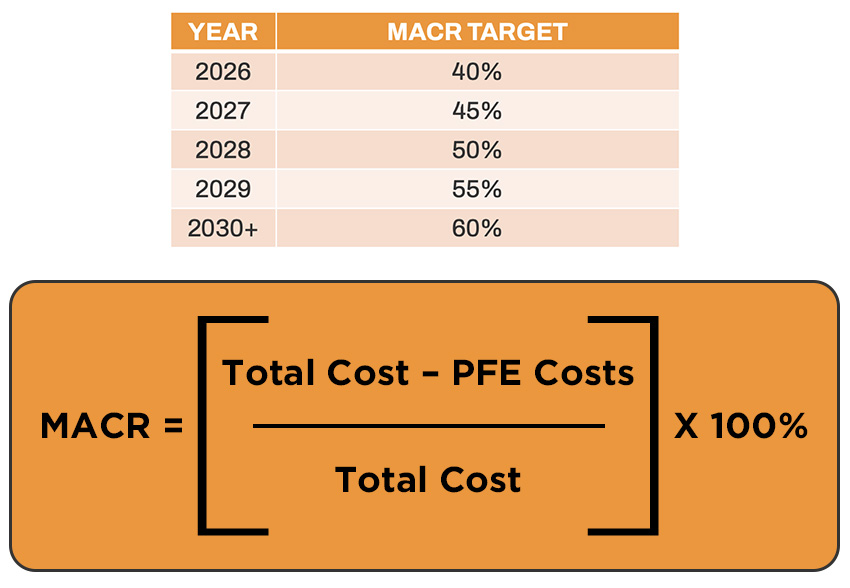

For calendar year 2026, the percentage is 40%.

Determining how to arrive at that percentage is determined through something called the Material Assistance Cost Ratio, or MACR. MACR is the total costs to the taxpayer for all manufactured products (and their subcomponents) that are incorporated into their project minus the costs attributable to Prohibited Foreign Entities (PFE), divided by the total costs, multiplied by 100%.

Reference the 2025-08 Safe Harbor Tables!

Thankfully, as an alternative to this math, Section 7701(a)(52)(D)(iii) of the OB3A allows us to “…use the tables included in Internal Revenue Service Notice 2025–08 to establish the percentage of the total direct costs of any listed eligible component and any manufactured product…”

For Racking that means looking for the same “Rails” and “Structural Fasteners” Manufactured Product Components (MPC) used for determining domestic content. Remember 40%.

NOTE: Be sure to check with your TPO and their approved vendor list.

DISCLAIMER: IronRidge complies with all applicable federal laws, regulations, and Treasury guidance related to Foreign Entity of Concern (“FEOC”) requirements. Please consult with the taxpayer or the taxpayer’s Approved Vendor List (AVL) for interpretations specific to their project(s). IronRidge does not provides tax, legal or accounting advice. This material has been prepared for informational purposes only and is not intended to be relied upon in place of professional advice. You should consult your own advisors before engaging in any transaction.